Do you need a payment gateway solution for eWallet payment?

With the increased adoption of eWallet payment solutions, more and more retailers are accepting payments through QR codes. This is a convenient and contactless way for customers to pay for their purchases, and it can help retailers reduce their costs.

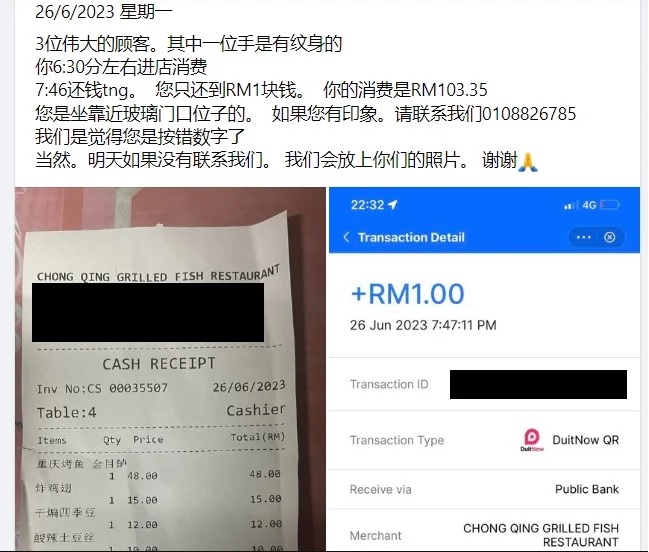

However, there are some risks associated with accepting payments

through QR codes. For example, customers could short-pay or not pay at all if

they scan a QR code that is not linked to your POS system.

This is where a reliable payment gateway service provider

comes in. A payment gateway service provider acts as an intermediary between

your POS system and the customer's bank. When a customer scans a QR code, the

payment gateway service provider validates the payment and sends the funds to

your POS system. This helps to ensure that you always receive the full amount

of the payment, and it also helps to protect your customers' financial

information, while the only difference in operational process is that you will be scanning the eWallet QR code of your customers. instead of

There are a number of factors to consider when choosing a

payment gateway service provider. Some of the most important factors include:

Security: The payment gateway service provider should have a

strong security system in place to protect your customers' financial

information.

Reliability: The payment gateway service provider should

have a proven track record of reliability. You don't want to have your payments

interrupted or delayed by a unreliable payment gateway service provider.

Fees: The payment gateway service provider should have

competitive fees. You don't want to be paying more than you need to for payment

processing.

Features: The payment gateway service provider should offer

the features that you need. For example, you may need a payment gateway service

provider that can process a variety of payment methods, or that can integrate

with your existing POS system.

If you are looking for a reliable payment gateway integrated POS solution, Appolous is a great option. On top on it's fool-proof user interfaces and comprehensive business applications (which includes POS, Inventory Management, SCM, HRM, CRM etc), Appolous offers a

secure, reliable, and affordable payment gateway service. They also offer a

variety of features that can make it easy to accept payments through QR codes.

In addition to the factors mentioned above, you should also

consider the following when choosing a POS system service provider:

Customer support: The POS system provider

should offer excellent customer support. You should be able to get help quickly

and easily if you have any problems with the payment gateway service.

Scalability: The POS system provider should be

able to scale with your business. As your business grows, you should be able to

easily add more payment methods or increase your transaction volume, or branches without

having to change your POS system and payment gateway solution.

Compliance: The payment gateway service provider should be in compliance with all applicable laws and regulations. This is important to protect your business and your customers.

By selecting a trusted provider, retailers can safeguard themselves against short payments or non-payments resulting from customers scanning retailer's QR codes. It is essential for businesses to prioritize security, integration, real-time monitoring, and dispute resolution support when evaluating payment gateway service providers.

Remember, when it comes to payment gateway services,

reliability is key. By partnering with a reputable provider, retailers can

enhance customer experiences, minimize financial risks, and focus on what they

do best—serving their customers and growing their businesses.